NOTICE: Internet Explorer was retired by Microsoft on June 15th, 2022 and is no longer supported. This could change how you access Online Banking.

Our banking centers close at 12pm on 12/24 through Christmas Day. Transactions scheduled at that time will be processed the next business day.

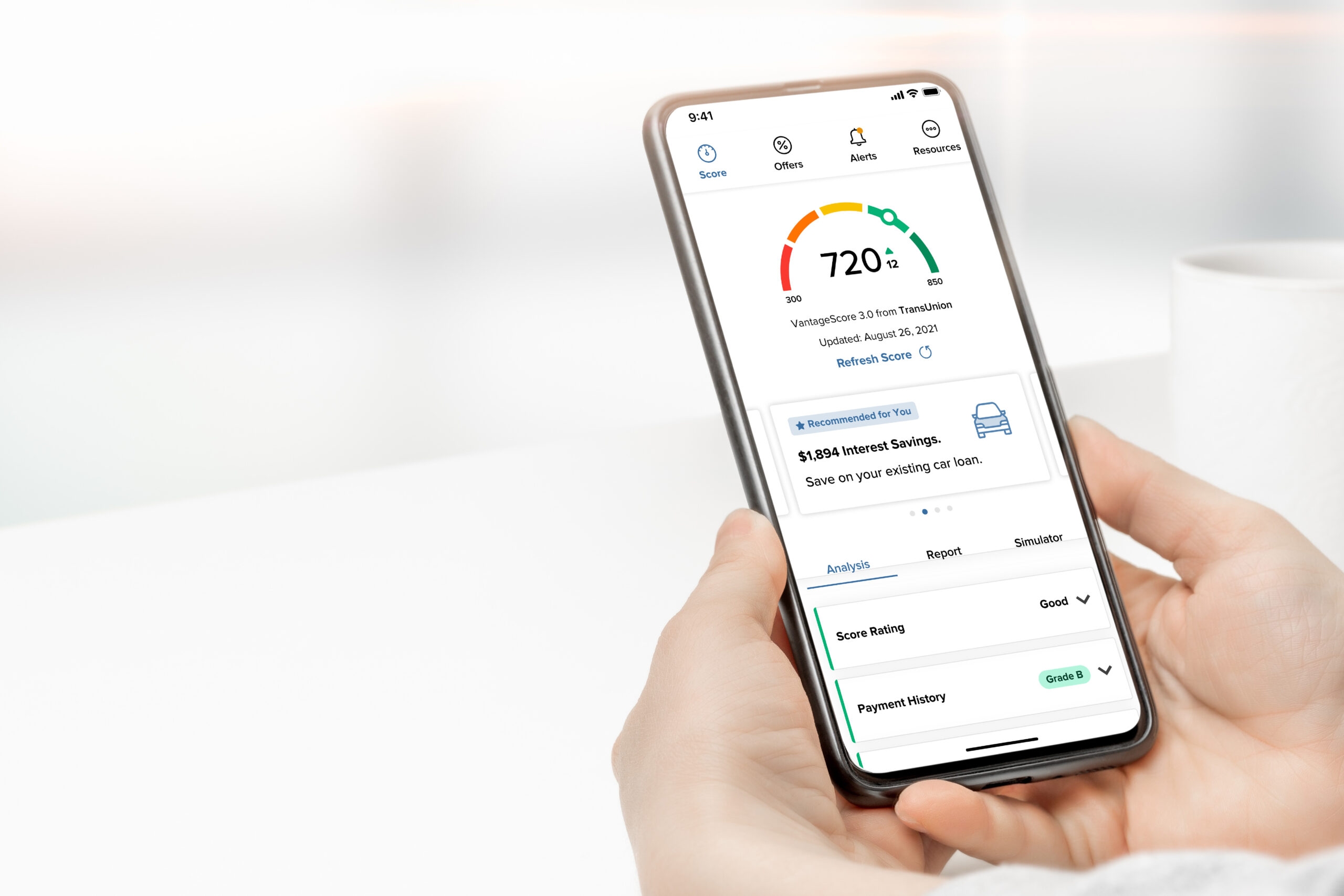

Credit Insights

Introducing Your Credit Score. And More. Anytime. Anywhere. In Your Mobile App.

Staying on top of your credit has never been easier.

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education. You can do this anytime and anywhere in your WesBanco Mobile app. Our Credit Score feature is safe, secure and doesn’t affect your credit score.

Enroll in Credit Score

Our Credit Score feature provides an added level of credit protection by providing real-time credit monitoring alerts. It also has financial tips and education to help you understand the factors that make up your credit score and ways to improve it.

You are able to access your credit score and report in your Mobile app by tapping “Credit Score” on the main page and then click enroll. It’s that easy! Once enrolled, you will be able to see your credit score every time you open your Mobile app by clicking “View Credit Score.”

Follow the steps below to enroll:

- Log into the WesBanco Mobile App.

- Tap “Credit Score” at the bottom of the homepage.

- Swipe through the next three screens to learn more about the features of Credit Score and on the last screen select “Get Started”.

- Agree to the terms and conditions by selecting the checkbox and select “Continue”.

From your Credit Score dashboard, you can select Analysis, Report, Simulator, and Goals tabs to view an in-depth breakdown of your credit score, and access key features to help you reach your credit score goals.

Credit Monitoring

Credit Score also monitors your credit reports daily. It informs you by email if any significant changes are detected, such as a new inquiry, a new account opened, a change in address or employment, or delinquency has been reported. Credit Monitoring helps you keep an eye out for identity theft.

Credit Score Simulator

A score simulator is an interactive tool that allows you to select various actions you may take and see how your score could be affected. Different actions like paying off a credit card balance might make your score move up or down. Just like using Credit Score, using the simulator will not affect your actual credit score.

Financial Checkup

Financial Checkup offers a complete view of your financial health, covering spending details, cash flow, and analyses of budgets and debt-to-income ratios. Picture this — personalized tips and recommended steps guiding you to informed decisions and a financially vibrant future.

To access Financial Checkup, open your WesBanco Mobile App, tap on Credit Score and navigate to Financial Checkup to take a quick Q&A Financial Assessment to better understand your financial situation. You will then receive personalized recommendations to plan for future financial decisions and a full financial outlook to improve your overall financial well-being.

Frequently Asked Questions

-

No. It’s entirely Free, and no credit card information is required to register.

-

If you regularly access your Mobile app, your credit score will be updated every 7-days and displayed within your Mobile app. You can also refresh your credit score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Dashboard within your app.

-

No. Checking credit score on our Credit Score feature is a “soft inquiry” which does not affect your credit score.

-

Using Mobile Banking, you can enroll in Credit Score by clicking “View Credit Score” on the main screen then click to enroll.

-

There are five major categories that make up a credit score:

40% Payment History

Essentially what lenders want to know is whether or not you’re good about paying your loans on time.

23% Credit Usage

Credit usage, also known as credit utilization, is the ratio between the total balance you owe and your total credit limit on your revolving accounts. It is best to keep your credit usage below 30%.

21% Credit Age

The age of your oldest account, the age of your newest account, the average age of your accounts and whether you’ve used an account recently are all factors related to the length of your credit history. In general, the longer your credit history the better.

11% Mix of Credit

Your score also takes into consideration how many total accounts you have and what types of credit you have. Your score will likely be higher if you have experience with different types of credit, like mortgages and installment student loans and revolving accounts like credit cards.

5% Recent Credit

Opening multiple credit accounts in a short period of time could represent a greater risk for lenders – those who see that you have multiple recent inquiries may worry that you are applying to so many places because you are unable to qualify for credit – or because you need money in a pinch.

-

There are several ways to improve your credit score. But it’s much more important to focus on improving what’s in your credit report rather than obsessing over your credit score. Here is some general advice:

- Pay your bills on time. How promptly you pay your bills has the strongest influence on your credit score.

- Apply for credit only when you need it. Do not open too many accounts too frequently. And avoid opening multiple accounts within a short time span.

- Keep your outstanding balances low. A good rule of thumb? Keep balances below 30 percent of the credit limit on each of your revolving accounts.

- Reduce your total debt. It is not necessarily bad to owe some money. But it is not good to owe too much money. Consider paying down some of your outstanding loans.

- Build up a credit history. Maintaining a timely payment history for a mix of accounts (e.g. credit cards, auto, mortgage) over a longer period can improve your score.

-

Each credit bureau has its process for correcting inaccurate information, but every user can “File a Dispute” by clicking on the “Dispute” link within the Credit Score credit report.