NOTICE: Internet Explorer was retired by Microsoft on June 15th, 2022 and is no longer supported. This could change how you access Online Banking.

Our banking centers close at 12pm on 12/24 through Christmas Day. Transactions scheduled at that time will be processed the next business day.

Communities

Impacting Communities through Strategic Partnerships and Investment

At WesBanco, we strive to be a leader in community development by positively impacting the communities in which we live and serve. We have developed responsible strategies to provide targeted investment, deployment of capital, financial education, technical assistance, and innovative products and solutions that achieve financial inclusion for all. Our vision is to create greater economic opportunities that provide:

- The dignity of affordable housing;

- The empowerment of financial inclusion;

- The strength of successful businesses; and

- The sustainability of vibrant communities.

WesBanco Bank Community Development Corporation

An important part of our community development strategy is the activities of the WesBanco Bank Community Development Corporation (“WBCDC”), a WesBanco Bank affiliate and a certified Community Development Entity. The WBCDC’s New Markets Loan Program is a revolving small dollar loan program that funds a variety of businesses providing critical social and commercial services to low-income residents and to benefit highly distressed, low-income communities. Funds have supported a wide range of businesses including manufacturing, food, retail, housing, health, technology, energy, education, and childcare. To read the full report and see the New Markets Loan Program in action, click here.

WesBanco … We Make Change

The “We” in WesBanco is symbolic of the commitment of our entire company – from our directors to each employee – to build strong, resilient, and vibrant communities. We recognize the importance of our role to responsibly reinvest the funds entrusted to us by depositors back into the community. We view our Community Reinvestment Act (CRA) responsibilities not just as obligations but as opportunities to leverage capital, resources, innovation, and financial expertise to positively impact our neighborhoods and the greater world in which we live. We have identified “5 Pillars of Community Development” that serve as the foundation of our efforts.

5 Pillars of Community Development

-

A primary focus of our community development effort is to develop responsive and innovative products, programs, and initiatives to ensure financial and economic inclusion and to provide access to banking services for all consumers and business owners. We strive to ensure communities throughout our footprint retain access to the capital and investment that will retain businesses and attract residents. WesBanco’s loans and deposits reflect the markets in which we operate.

Ensuring Access to Banking Services

WesBanco employs on-going evaluation strategies to assess that the locations of our banking centers are properly aligned to serve our customers’ needs most effectively. The Community Development Department monitors the branch distribution network to ensure that it reasonably aligns to area demographics, especially in low- and moderate-income areas, areas with highly diverse populations, and rural, underserved areas. In addition to our brick and mortar branches, we employ a number of alternative delivery mechanisms to serve our customers, including automatic teller machines (with access to thousands of surcharge-free machines), mobile banking, internet banking with online bill pay, person-to-person service, telephone banking, and bank-by-mail. Additionally, we offer online deposit account opening (checking and savings) and online mortgage and small business loan applications.

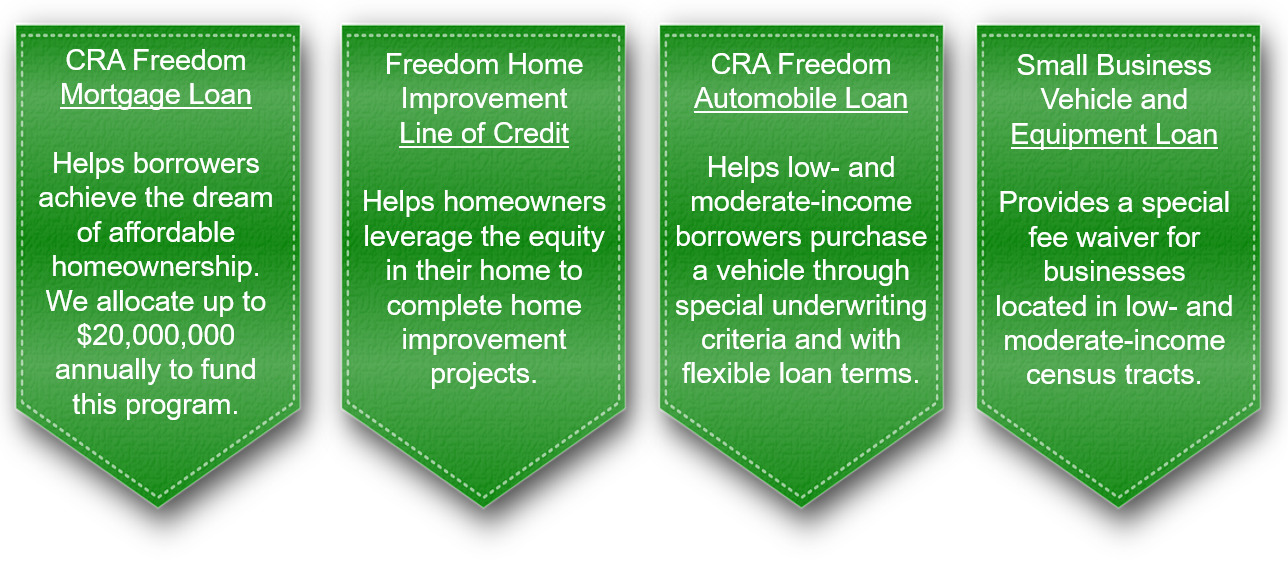

Proprietary Lending Products

WesBanco’s CRA Freedom Loan Product Suite is designed with special underwriting criteria and reduced fees to meet the needs of low- and moderate-income borrowers and improve low- and moderate- income neighborhoods.

WesBanco also offers an Amish Mortgage Lending Program to assist those in the Amish Community who may be unable to be underwritten using traditional criteria due to the lack of credit score or other factors. Further, we offer the WesBanco Weather and Storm Damage Loan Program, which features a fixed-rate loan with no loan fees or closing costs, that is activated when severe weather and storms affect our communities, residents, and business owners.

WesBanco also offers an Amish Mortgage Lending Program to assist those in the Amish Community who may be unable to be underwritten using traditional criteria due to the lack of credit score or other factors. Further, we offer the WesBanco Weather and Storm Damage Loan Program, which features a fixed-rate loan with no loan fees or closing costs, that is activated when severe weather and storms affect our communities, residents, and business owners.Financial Education

Financial literacy is fundamental to eliminating the barriers that prevent financial inclusion for individuals and families. We rely on the expertise of our employees to provide financial education to students and adults, including homeownership counseling, credit, wealth building, budgeting, saving, financial exploitation and fraud, as well as topics of concern to small business. In addition to providing specialized curricula targeted to specific needs, we participate annually in the American Bankers Association’s “Teach Children to Save” and “Get Smart about Credit” initiatives to deliver financial education to school classrooms. We supplement this participation with a School Savings Program, to encourage children to save.

Further, we offer the WesBanco Saves program, under the national “America Saves” initiative, to motivate individuals and families to save, build wealth, and reduce debt. This account earns interest and features no minimum deposit and no minimum balance as savers pledge to save regularly towards their own savings goal, e.g. an emergency fund, debt repayment, homeownership, or retirement. WesBanco also offers a number of webinars, free-of-charge, on our website that cover a wide-range of finance topics, including, avoiding fraud, financial wellness, life planning, growing a business, retirement planning, buying a home, managing credit.

-

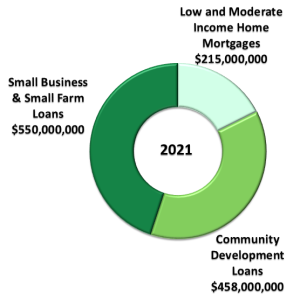

In Community Development, we prioritize small business and small farm lending, community development lending, and home mortgage lending for low- and moderate-income borrowers. To create strong and prosperous communities that provide opportunities for both small and large businesses to thrive and for individuals and families to find a place to call home, WesBanco is committed to funding:

- Consumer loans for home purchases and refinance, home improvement, and other consumer needs;

- Business loans for small and large companies that create and retain jobs in the community and provide essential goods and services;

- Commercial loans for community development projects that build affordable housing, provide healthcare, revitalize distressed areas, and fund vital economic development strategies;

- State and local government bonds that provide financing for crucial community projects and operations; and

- Loans to non-profit organizations that provide essential community development services.

-

At WesBanco, we utilize strategic partnerships to provide innovative financing options for our customers and to engage in initiatives that transform and revitalize communities. We leverage partnerships with non-profit organizations, governmental and quasi-governmental entities, and other third-party service providers to offer an extensive list of community development programs.

We partner with:

- Federal Home Loan Bank of Pittsburgh

- United States Small Business Association

- USDA Rural Development

- Federal Housing Administration

- U.S. Department of Agriculture

- Veteran’s Administration

- State Housing Associations

- Freddie Mac

- Fannie Mae

- Other state and federal agencies

-

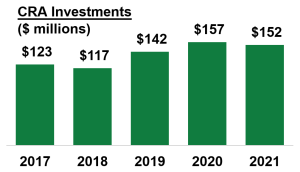

WesBanco’s commitment to community development is based on the principle of returning assets to the community. Our annual CRA investment goal ensures a significant level of community development investment that will provide capital for new businesses, create affordable housing opportunities, provide assistance to non-profit community organizations, and fund state and local bonds that construct and improve schools, roads, water systems, government buildings, community facilities, and that improve access to broadband internet. We generally invest in:

- Low-Income Housing Tax Credits (“LIHTC”);

- State and local bonds;

- Mortgage backed securities;

- Equity investments including funds for venture capital;

- Equity equivalent investments that fund Community Development Financial Institutions (“CDFIs”); and

- Targeted investments for community and economic development.

Additionally, as part of our overall investment strategy, we provide philanthropic donations to hundreds of worthwhile organizations throughout our footprint. These contributions provide critical support to address issues such as diversity and inclusion, employment, housing, education, financial literacy, healthcare, and community and social services including food insecurity and homelessness. We are especially proud of our participation in programs that provide impactful community and economic development to revitalize communities and neighborhoods. In addition to charitable contributions, through our corporate sponsorship program we provide sponsorships to local organizations and groups to support activities throughout our communities.

$3,600,000 in Total Community Development Philanthropic Donations, 2017-2021

Furthermore, we routinely provide “in-kind” donations of furniture, fixtures, office supplies, and other tangible assets to organizations and schools throughout our communities.

Neighborhood Partnership Program (“NPP”)

from the Pennsylvania Department of Economic DevelopmentThe NPP provides a multi-year donation to a non-profit organization working on a strategic plan that will improve the quality of life for the residents of a specific area targeted for revitalization. WesBanco has provided and funded NPP commitments totaling $2.1MM for six communities throughout Western Pennsylvania. These funds build affordable housing, spur downtown development, construct community facilities, and provide community services to residents.

-

At the heart of WesBanco’s successful community development program is its commitment of time and resources to our communities. We are a leader in performing highly qualified community development services throughout each of our CRA assessment areas. WesBanco directors, officers, and employees provided technical assistance or financial education to organizations and agencies that promote affordable housing, economic development, revitalization or stabilization of low-income and other distressed communities, and services for low- and moderate-income persons and other disenfranchised populations. WesBanco participates in many fund-raising events for worthy organizations throughout our footprint, such as for the United Way, Easter Seals, March of Dimes, American Heart Association, American Cancer Society Relay for Life and Rally for the Cure, American Red Cross, and the Shriners Medical Center, among others.

57,859 Total Community Development Service Hours from 2017-2021

We have a robust outreach program across all business lines that provides opportunities for our employees to call on non-profit organizations, community development service providers, economic development organizations, and small and large businesses to ensure we are assessing the needs of our communities. This outreach, along with our service activities, often leads to speaking opportunities for our employees to relay their banking knowledge and experiences for local, state, regional, or national events and conferences, as well as to contribute to industry publications.

Investor Relations

Our distinct long-term growth strategies are built upon unique sustainable advantages permitting us to span six states with meaningful market share. Learn more about investing in WesBanco.

Visit Investor Relations